Pocket Option Fees: Everything You Need to Know

When trading on the Pocket Option platform, understanding the different Pocket Option Fees комиссии на Pocket Option is crucial. In this article, we will delve into various fees associated with Pocket Option and how they can affect your trading experience.

Introduction to Pocket Option

Pocket Option is an innovative online trading platform that provides users with the ability to trade various assets, including forex, cryptocurrencies, stocks, and commodities. As with any trading platform, it is essential for traders to be aware of the fees that may apply during their trading activities. These fees can impact overall profitability, making it vital to understand them fully before engaging in trades.

Types of Fees on Pocket Option

Pocket Option fees can generally be categorized into several types, including trading fees, deposit fees, withdrawal fees, and inactivity fees. Understanding each type and how they work can help traders make informed decisions and optimize their trading strategies.

1. Trading Fees

Trading fees are the costs incurred when executing trades on the platform. On Pocket Option, the trading fees are incorporated into the bid-ask spread, meaning that there are typically no additional fees charged directly for placing trades. However, it’s important to note that the cost of trading can still be influenced by the spread, which may vary depending on market conditions and the asset being traded.

2. Deposit Fees

When funding your Pocket Option account, you may encounter deposit fees depending on the method of payment used. The platform supports a variety of payment options, including credit/debit cards, bank transfers, and e-wallets. While some methods may incur a fee, others could be offered for free. Be sure to check the specific fees associated with each deposit method before making a transfer.

3. Withdrawal Fees

After successfully trading on Pocket Option, you may wish to withdraw your profits. Withdrawal fees can vary based on the method of withdrawal selected. As with deposits, certain withdrawal methods might have fees while others might not. It’s advisable to review these fees in advance to avoid any unexpected deductions when you process a withdrawal.

4. Inactivity Fees

Pocket Option may impose inactivity fees on accounts that have had no trading activity for an extended period. This fee serves to encourage users to remain active on the platform. If you plan to take a break from trading, make sure to familiarize yourself with the inactivity fee policy and consider any necessary actions to keep your account in good standing.

Impact of Fees on Trading Strategy

The various fees associated with trading on Pocket Option can have a significant impact on your overall trading strategy and profitability. Traders should factor in these costs when calculating their potential profits and losses. For instance, understanding trading fees can help you determine how to set your profit targets effectively.

Additionally, by selecting the most cost-effective deposit and withdrawal methods, traders can preserve more of their profits, enhancing their overall return on investment. To maximize profits, it’s also essential to maintain an active trading account and avoid inactivity fees.

Comparing Pocket Option Fees to Other Platforms

When assessing any trading platform, it is important to compare their fee structures with competitors. Different trading platforms come with various fee structures—some may charge higher trading fees but offer lower deposit or withdrawal fees. Others may provide a flat fee structure that could be advantageous depending on the trading volume and assets traded.

Pocket Option’s unique approach to fees, particularly offering a spread-inclusive trading fee, can be attractive for traders looking to streamline their costs. When comparing Pocket Option to other platforms, keep in mind factors such as efficiency, customer service, and the variety of trading options available alongside the fee structure.

Tips for Minimizing Trading Costs

Here are some strategies that traders can implement to minimize trading costs on Pocket Option:

- Choose Your Payment Methods Wisely: Opt for payment methods with the lowest associated fees for both deposits and withdrawals.

- Stay Active: Regularly engage in trading activities to avoid inactivity fees.

- Plan Your Trades: Analyze trades carefully to ensure that the potential returns justify the transaction costs.

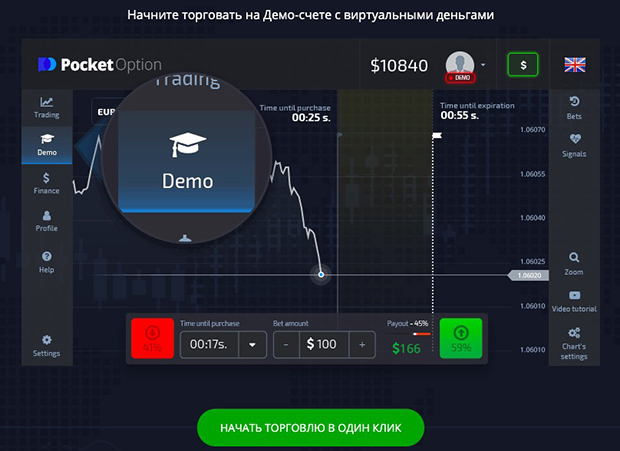

- Utilize Demo Accounts: Practice trading with a demo account to develop strategies without incurring real costs.

Conclusion

Understanding the fee structure of Pocket Option is crucial for optimizing your trading experience. By familiarizing yourself with trading fees, deposit and withdrawal charges, and inactivity fees, you can make better-informed decisions that contribute to your overall trading success. Compare these fees with other trading platforms and apply strategies to minimize costs, ensuring that your trading journey on Pocket Option remains as profitable as possible.