top-ten-92101-blogs/myth-2-there-is-a-glut-of-inventory-in-downtown-san-diego/141/

MYTH # 2: There is a glut of inventory in Downtown San Diego. Sellers, Developers, and Banks are panic selling.

Not a day goes by in this real estate business that either a past client or current buyer asks me to elaborate on the state of the market, and in what direction things are headed. This is always the trick question, because none of us really have our crystal balls. If I had had one of those, I definitely would not have stayed up until 1:30 in the morning last night to watch the Padres loose to the Rockies in the longest game of Petco history.22 Innings! Here I digress.back to the State of the Market which ultimately comes down to Real Estate/Econ 101 and that fantastic invention.the supply demand curve. This is the point where current levels of Downtown San Diego inventory and the public perception (I.E. Myth #2) come into play.

In the case of inventory I tell my clients to never believe an article that speaks of doom and gloom, and then never give any hard numbers to consider (Union Tribune articles?). With that said, obviously the numbers never lie. It is not my job to sell anyone on a glut or not. I do not need to sell headlines, so I trust that after presenting the facts, you will ultimately be savvy enough to make up your own minds.

Before we get into the hard facts, lets pull back and put some perspective and context on what has actually happened in Downtown San Diego relative to inventory levels since the beginning of 2007 until now.2nd Quarter of 2008. Last year we saw the delivery of over 1,892 new units to the overall inventory of Downtown San Diego homes. This was not only the largest push of inventory to Downtown ever, but in case anyone is paying attention; that is over 17% of the total inventory in all of Downtown (Currently @ 88 projects and 10,926 homes). This push also coincided with the decline of the subprime and financing markets. It is important to consider the historical perspective, because it caused the Real Estate Inventory to be separated into three distinct categories that still exist today: Resale Market, Developer Owned Sales, and the Distressed Market. This is so critical to understand, because inventory is given in total numbers even though each market has its own story, and its own sale statistics.

So finally the numbers: According to SDLOOKUP.com and Market Pointe Realty Advisors

• Resale Inventory is 601 homes or 5.5% of total inventory.

• Distressed Inventory is 83 homes or .76% of total inventory. (For obvious reasons, I have chosen to exclude Short Sales and Pre-Foreclosures b/c of their unknown timing and outcome)

• Developer Owned Unit Inventory is 743 new homes or 6.8% of total inventory. (This number excludes 707 units under construction, because full delivery is not until Spring of 2010)

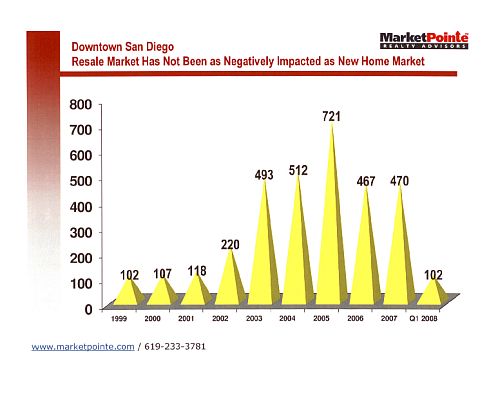

Figure 1.0

Ok.if you are with me thus far, it means that we have covered the supply part of the equation. In order to examine demand, it is again beneficial to take a look at the historical figures leading up to last years statistics and the first Quarter of 08. For this task, lets take a look at a couple of graphs. In Figure 1.0, you will see yearly numbers of resale home closings in 92101. Aside from the incredible numbers of 2005(the time when flipping was alive and well Downtown), 2007 looks very similar to 2003, 2004, and 2006.

Ok.if you are with me thus far, it means that we have covered the supply part of the equation. In order to examine demand, it is again beneficial to take a look at the historical figures leading up to last years statistics and the first Quarter of 08. For this task, lets take a look at a couple of graphs. In Figure 1.0, you will see yearly numbers of resale home closings in 92101. Aside from the incredible numbers of 2005(the time when flipping was alive and well Downtown), 2007 looks very similar to 2003, 2004, and 2006.

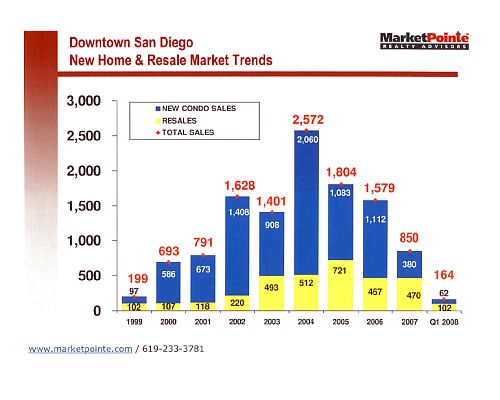

Figure 2.0

In Figure 2.0, we see the Downtown new-home historical sales statistics. Yes, there is a significant drop from 2006 to 2007 because flipping and speculation came to a screeching halt. Investors were no longer buying from developers and sales offices only to turn around and put the same unit on the resale market for a higher price. This was a very significant change, because it started to strengthen the integrity of investments Downtown. We would no longer have speculators driving up the costs of homes unnecessarily, we now have a new generation of long term urban homeowners who would be buying into and supporting the infrastructure of Downtown and its specific neighborhoods.

In Figure 2.0, we see the Downtown new-home historical sales statistics. Yes, there is a significant drop from 2006 to 2007 because flipping and speculation came to a screeching halt. Investors were no longer buying from developers and sales offices only to turn around and put the same unit on the resale market for a higher price. This was a very significant change, because it started to strengthen the integrity of investments Downtown. We would no longer have speculators driving up the costs of homes unnecessarily, we now have a new generation of long term urban homeowners who would be buying into and supporting the infrastructure of Downtown and its specific neighborhoods.

Now that we are able to see both supply and demand sides, the QUESTION becomes: When will we see a shift in the supply demand curve?

ANSWER: As developer units deplete, a buyer will have less to choose from, and have to go to the resale market exclusively for their choices. New construction and developer units will continue to have some of the best deals in the Downtown market until the middle/end of summer 08. By this time (as it is already starting to happen) the availability of developer units in certain price ranges will be completely picked over or sold out. As this starts to happen, the resale market strengthens, because it no longer has to compete with the healthy developer incentives to make a sale. This will continue to happen for the next 2 years as there will be very little new inventory delivered (only 707 units), and only those people who ultimately have to sell will choose to enter the market. All information indicates that the distressed market will continue to get worse before it gets better. In the lower price ranges, this market will continue to generate good deals. But, overall the distressed market will not drive inventory, as over 90% of the foreclosures in Downtown are under $500k!